WASHINGTON — The National Federation of Independent Business (NFIB) Small Business Optimism Index declined by 3.3 points in March to 97.4, falling just below the 51-year average of 98. The Uncertainty Index decreased eight points from February’s second-highest reading to 96.

“The implementation of new policy priorities has heightened the level of uncertainty among small-business owners over the past few months,” says NFIB Chief Economist Bill Dunkelberg. “Small-business owners have scaled back expectations on sales growth as they better understand how these rearrangements might impact them.”

Key findings in the NFIB report include:

- The percentage of small-business owners reporting taxes as their single most important problem rose two points from February to 18%. The number of owners reporting “Taxes” as their top small-business issue has not been this high since November 2021.

- The net percentage of owners expecting better business conditions fell 16 points from February to a net 21% (seasonally adjusted). This is the third consecutive monthly decline and the largest monthly decline since December 2020.

- When asked to rate the overall health of their business, 11% of owners reported “excellent” (unchanged), and 53% reported “good” (down two points). Thirty-one percent reported their business health was “fair” (up four points) and 4% reported “poor” (down two points).

- The percentage of small-business owners reporting labor quality as the single most important problem for their business was unchanged from February at 19%, remaining the top issue, with taxes one point behind.

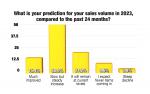

- The net percentage of owners expecting higher real sales volumes fell 11 points from February to a net 3% (seasonally adjusted). This is the third consecutive month real sales expectations declined after surging from recession levels after the election.

- Sixteen percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), unchanged from February and falling from its rank as the second top issue.

- The net percentage of owners raising average selling prices fell six points from February to a net 26% seasonally adjusted. This is the largest monthly decrease since December 2022, but still historically high.

- Seasonally adjusted, a net 30% planned price hikes in March, up one point from February and the highest reading since March 2024.

In its monthly jobs report, the NFIB found that a seasonally adjusted 40% of all small-business owners reported job openings they could not fill in March, up two points from February. Of the 53% of owners hiring or trying to hire in March, 87% reported few or no qualified applicants for their positions. A seasonally adjusted net 12% of owners plan to create new jobs in the next three months, down three points from February.

Labor costs reported as the single most important problem for business owners fell one point in March to 11%, only two points below the highest reading of 13% reached in December 2021. Seasonally adjusted, a net 38% reported raising compensation, up five points from February. A seasonally adjusted net 19% plan to raise compensation in the next three months, up one point from February.

Fifty-nine percent of owners reported capital outlays in the last six months, up one point from February. Of those making expenditures, 43% reported spending on new equipment, 27% acquired vehicles, and 16% improved or expanded facilities. Thirteen percent spent money on new fixtures and furniture and 5% acquired new buildings or land for expansion. Twenty-one percent (seasonally adjusted) plan capital outlays in the next six months, up two points from February.

A net negative 11% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up one point from February and the highest reading since March 2024. The net percentage of owners expecting higher real sales volumes fell 11 points from February to a net 3% (seasonally adjusted). This is the third consecutive month real sales expectations declined after surging from recession levels after the election.

Seasonally adjusted, a net 30% planned price hikes in March, up one point from February and the highest reading since March 2024. The net percentage of owners raising average selling prices fell six points from February to a net 26%, seasonally adjusted. This is the largest monthly decrease since December 2022. Sixteen percent of owners reported that inflation was their single most important problem in operating their business, unchanged from February.

The frequency of reports of positive profit trends was a net negative 28% (seasonally adjusted), four points worse than in February. Among owners reporting lower profits, 35% blamed weaker sales, 18% cited usual seasonal change, 11% blamed the rise in the cost of materials, and 8% cited labor costs. For owners reporting higher profits, 55% credited sales volumes, 16% cited usual seasonal change, and 11% cited higher selling prices.

Three percent of owners reported that financing and interest rates were their top business problem in March, unchanged from February. Twenty-eight percent of all owners reported borrowing on a regular basis, up four points from February’s lowest reading since May 2022. A net 6% reported their last loan was harder to get than in previous attempts, up four points from February and the largest monthly increase since September 2023. A net 4% reported paying a higher rate on their most recent loan.

Nine percent (seasonally adjusted) of owners reported that it is a good time to expand their business, down three points from February. When asked to rate the overall health of their business, 11% of owners reported “excellent” and 53% reported it as “good.” Thirty-one percent reported it as “fair,” and 4% reported it as “poor.”

Have a question or comment? E-mail our editor Dave Davis at [email protected].